Existing-home sales fell sharply in January, according to the National Association of REALTORS®’ latest Existing-Home Sales Report. While the headline numbers show a slowdown, affordability continues to improve — giving both buyers and sellers new reasons to stay engaged in the market.

Existing-home sales fell sharply in January, according to the National Association of REALTORS®’ latest Existing-Home Sales Report. While the headline numbers show a slowdown, affordability continues to improve — giving both buyers and sellers new reasons to stay engaged in the market.

The Big Picture

Month Over Month

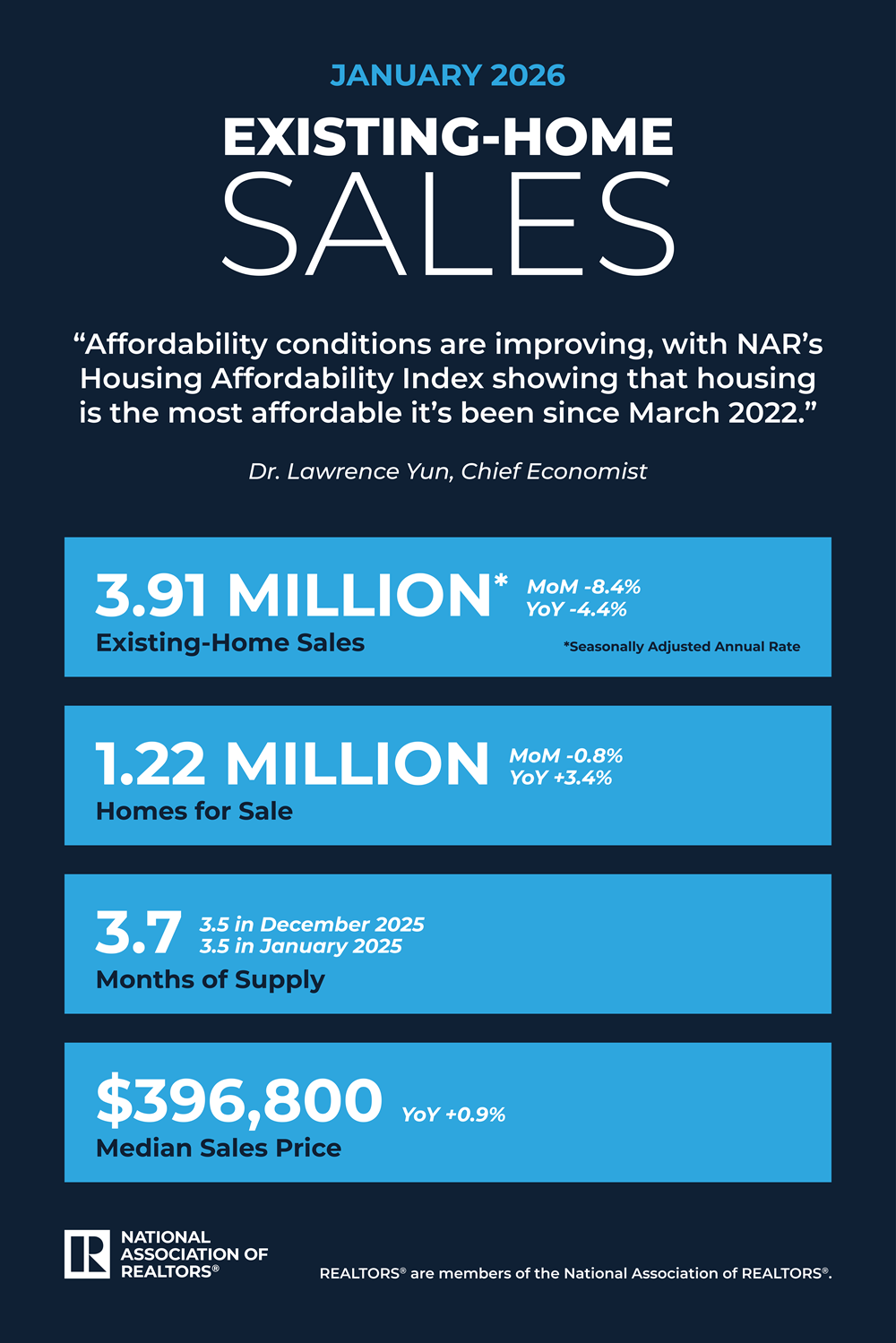

- Existing-home sales dropped 8.4%, reaching a seasonally adjusted annual rate of 3.91 million

- Unsold inventory declined slightly by 0.8%, totaling 1.22 million homes

- Housing supply sits at 3.7 months

Year Over Year

- Sales are down 4.4% compared to January 2025

- Median existing-home price rose 0.9%, now at $396,800

- Home prices have increased year-over-year for 31 straight months

What’s Driving the Shift?

NAR Chief Economist Dr. Lawrence Yun noted that January’s weather conditions may have played a role in the sales decline.

“The decrease in sales is disappointing… below-normal temperatures and above-normal precipitation make it harder than usual to assess the underlying driver,” Yun explained.

But there’s an encouraging trend: affordability is improving.

Affordability Gains Continue

The Housing Affordability Index rose again — marking the seventh consecutive month of improvement.

- Index increased to 116.5 in January

- Up from 111.6 in December

- Compared to 102.0 one year ago

Affordability improved across every region:

- Northeast: +9%

- Midwest: +12.2%

- South: +15.2%

- West: +17.1%

Inventory Remains the Key Challenge

Even with slightly more inventory than last year, supply remains tight. Yun emphasized that low supply continues to push prices higher.

“Due to low supply, the median home price reached a new high for the month of January.”

Since January 2020, the typical homeowner has gained roughly $130,500 in housing wealth — reinforcing how strong housing equity remains.

Buyer & Seller Trends REALTORS® Should Know

- Homes spent a median of 46 days on the market

- First-time buyers made up 31% of sales (up from 29%)

- Cash sales represented 27%

- Investors/second-home buyers dropped to 16%

- Distressed sales remained low at 2%

Mortgage Rates Offer Some Relief

Mortgage rates continue to ease:

- Average 30-year fixed rate: 6.10%

- Down from 6.96% one year ago

Lower rates + improving wages may help bring more buyers back into the market as we move into spring.

What This Means for REALTORS®

Even with January’s sales dip, affordability improvements and steady price growth show that the market remains resilient. The biggest opportunity — and challenge — continues to be inventory.

REALTORS® should focus on:

- Educating buyers on improving affordability

- Helping sellers understand strong equity positions

- Preparing for increased spring activity as rates stabilize