NCJAR News

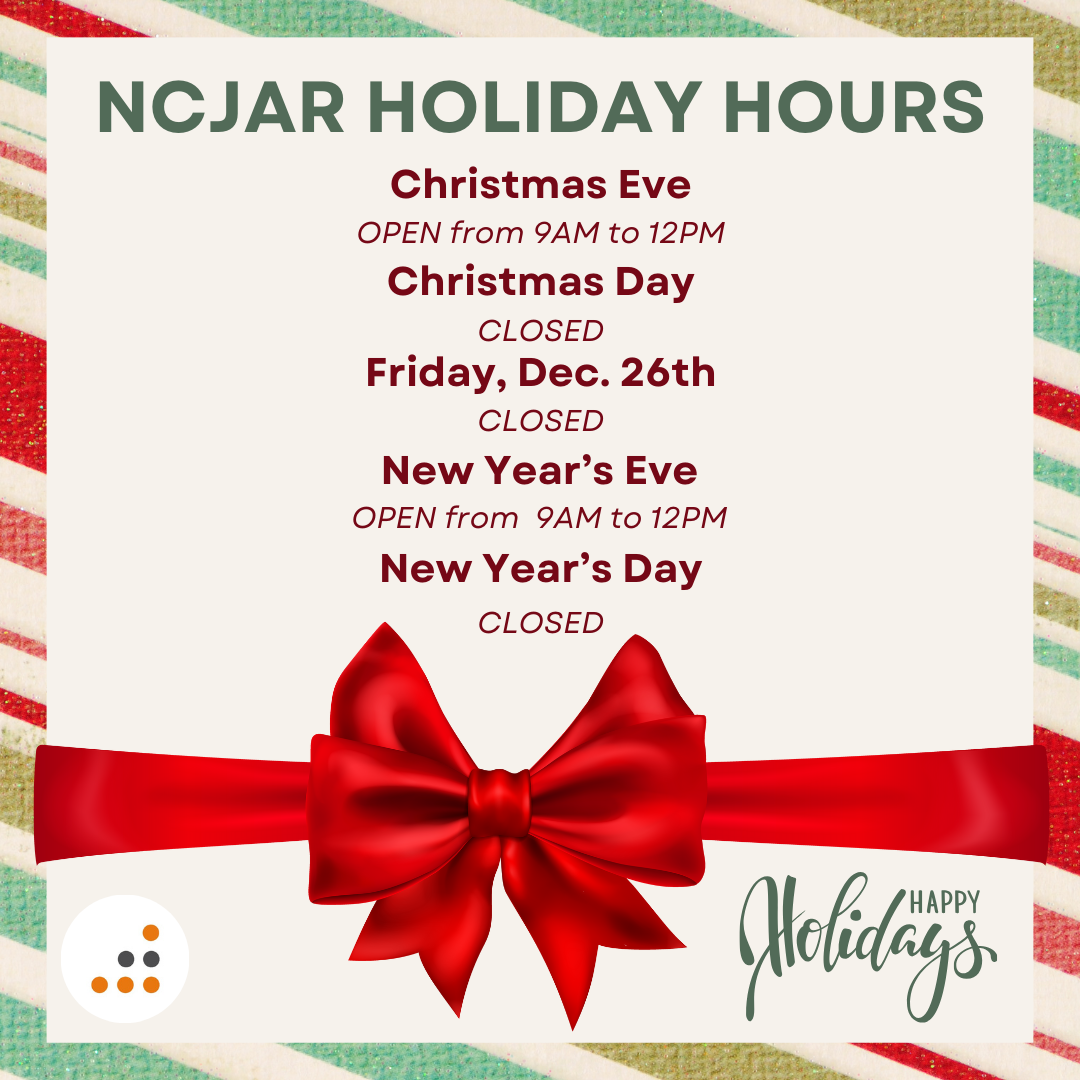

Please note our adjusted office hours for the upcoming holidays:

Please note our adjusted office hours for the upcoming holidays:

-

Christmas Eve: Open from 9:00 AM – 12:00 PM

-

Christmas Day: Closed

-

Friday, December 26th: Closed

Chris Coccia, Past President and Trustee of NCJAR®, shares a warm holiday message reflecting on the importance of community, gratitude, and Realtor® safety, while highlighting NCJAR’s continued commitment to supporting members in the year ahead. Visit www.NCJAR.com for more updates or email us at

U.S. sales of existing homes rose 1.2% from the previous month to a seasonally adjusted annual rate of 4.10 million, according to the National Association of REALTORS® (NAR), as buyers took advantage of lower mortgage rates this fall. Sales increased in the Midwest and South, held steady in the Northeast, and edged down in the West. Year-over-year, sales were up 1.7%, with gains in the Northeast, Midwest, and South, while the West posted a decline.

U.S. sales of existing homes rose 1.2% from the previous month to a seasonally adjusted annual rate of 4.10 million, according to the National Association of REALTORS® (NAR), as buyers took advantage of lower mortgage rates this fall. Sales increased in the Midwest and South, held steady in the Northeast, and edged down in the West. Year-over-year, sales were up 1.7%, with gains in the Northeast, Midwest, and South, while the West posted a decline.

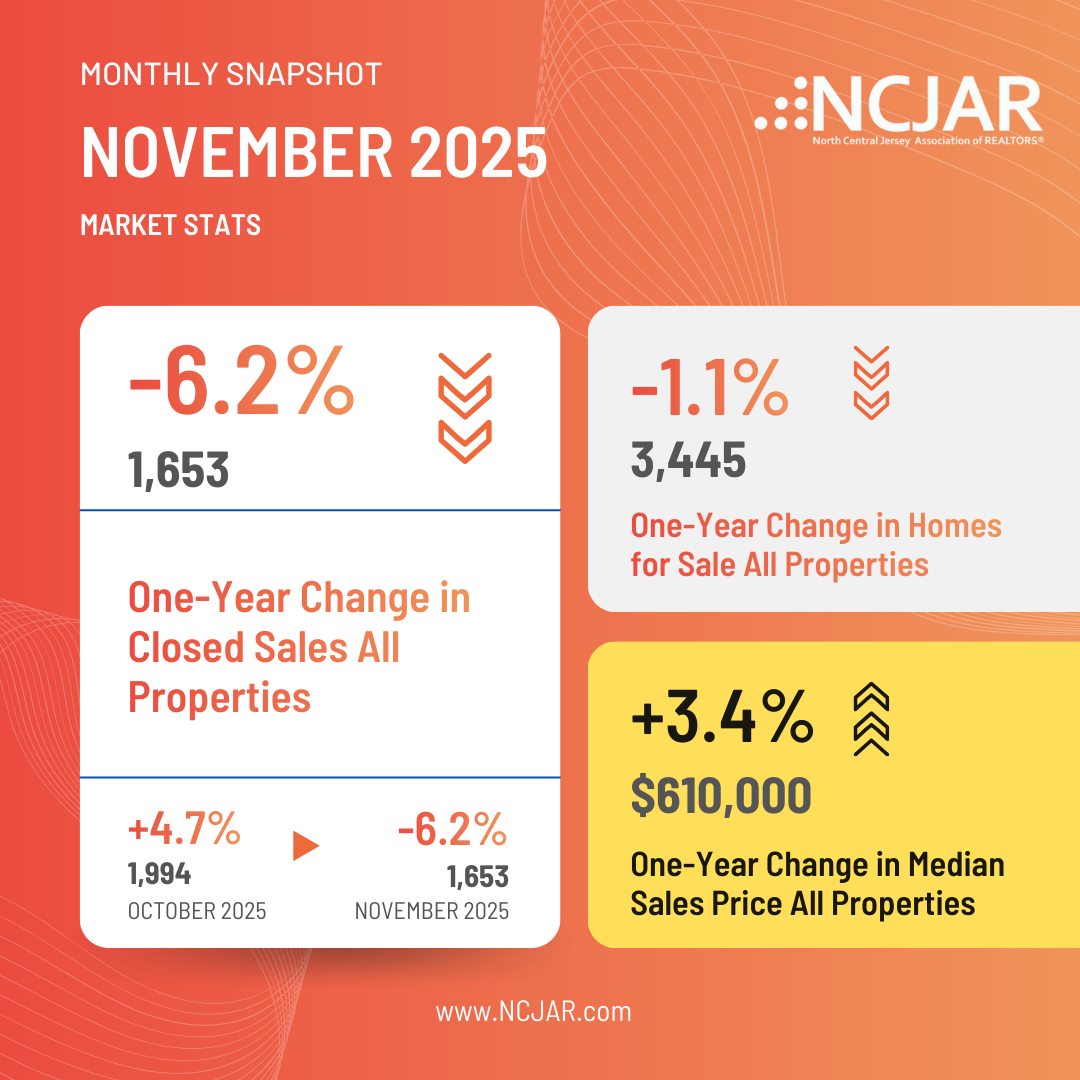

- Single Family Closed Sales were down 6.6 percent to 1,288.

- Townhouse-Condo Closed Sales were down 9.8 percent to 313.

- Adult Communities Closed Sales were up 40.5 percent to 52.

Financial hardship can happen when you least expect it. A job loss, medical emergency, natural disaster, or other unforeseen event can quickly put stress on your household budget—and your ability to keep up with mortgage payments.

Financial hardship can happen when you least expect it. A job loss, medical emergency, natural disaster, or other unforeseen event can quickly put stress on your household budget—and your ability to keep up with mortgage payments.

If you’re a homeowner facing financial challenges, it’s important to know this: you are not alone, and you do have options. Understanding those options early can help you protect your home, your credit, and your financial future.

Missed a Mortgage Payment? Act Quickly

If you’ve missed one or more mortgage payments—or think you might soon—the most important step is to contact your mortgage servicer as early as possible. Your servicer may offer mortgage-relief programs designed to help homeowners get back on track.

When discussing your options, be sure to ask how each choice may affect your credit score and long-term finances.